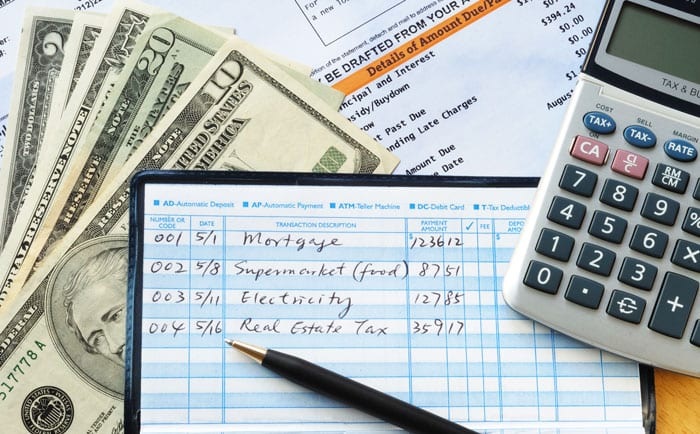

Managing a family’s finances properly begins with creating a household budget with one’s spouse or significant other. You and your spouse will have more control over your financial future if you create a budget and utilise it to carefully plan and manage your expenditures.

No other couple is going to be more budget-conscious than you two. According to the National Foundation for Credit Counselling (NFCC), only around 40% of American households create a monthly family budget that takes all costs into account.

Although it may be awkward to bring up, a couple may be able to save money and have more fun if they work together to create a budget. When you and your partner get down to create a budget, keep in mind that this is just a plan for how you intend to handle your shared finances. When you are budgeting as a couple then there are certain matters that you will have to keep in mind. The choices are open and so here are the points that you must abide by. For best results you must go for it now.

Creating a new household budget

Given the options available, deciding on the most effective method of budgeting may seem daunting at first. Don’t forget that you and your partner may find the work to be rewarding and enjoyable. The process may be broken down into six stages for easier comprehension:

Could you please itemise and roughly estimate all of your revenue sources?

It’s important to know where you are financially and how you’ll manage to meet all of your commitments. Actually, dividing your money up into several pots is the first step in budgeting.

Before beginning to generate a budget, you and your partner should each prepare a detailed inventory of all the cash you anticipate receiving over the budgeting period. This is the first step in the process. This time frame might be as short as a week or as long as a month.

After narrowing down your options, you can evaluate the potential gains from each one and make a more informed decision. By combining these figures together, one may determine whether household income is sufficient to cover monthly expenses.

Be sure to carefully document all of the money you put on home improvements.

Once you know how much money is coming in, you may go on to the budgeting stage. There are monthly expenses that always fall on the same day. It will be much easier to keep track of your spending and stick to your budget if you divide your money into distinct buckets.

Estimate how much money you will need to spend in total.

There may be recurring charges, however the final cost may change. Before a new budget is released, it is essential to take stock of all invoices and costs that have not yet been paid. Following these points you can be sure that you are getting the best budget solution for the family. Then the solution will be the best.